Swings into June

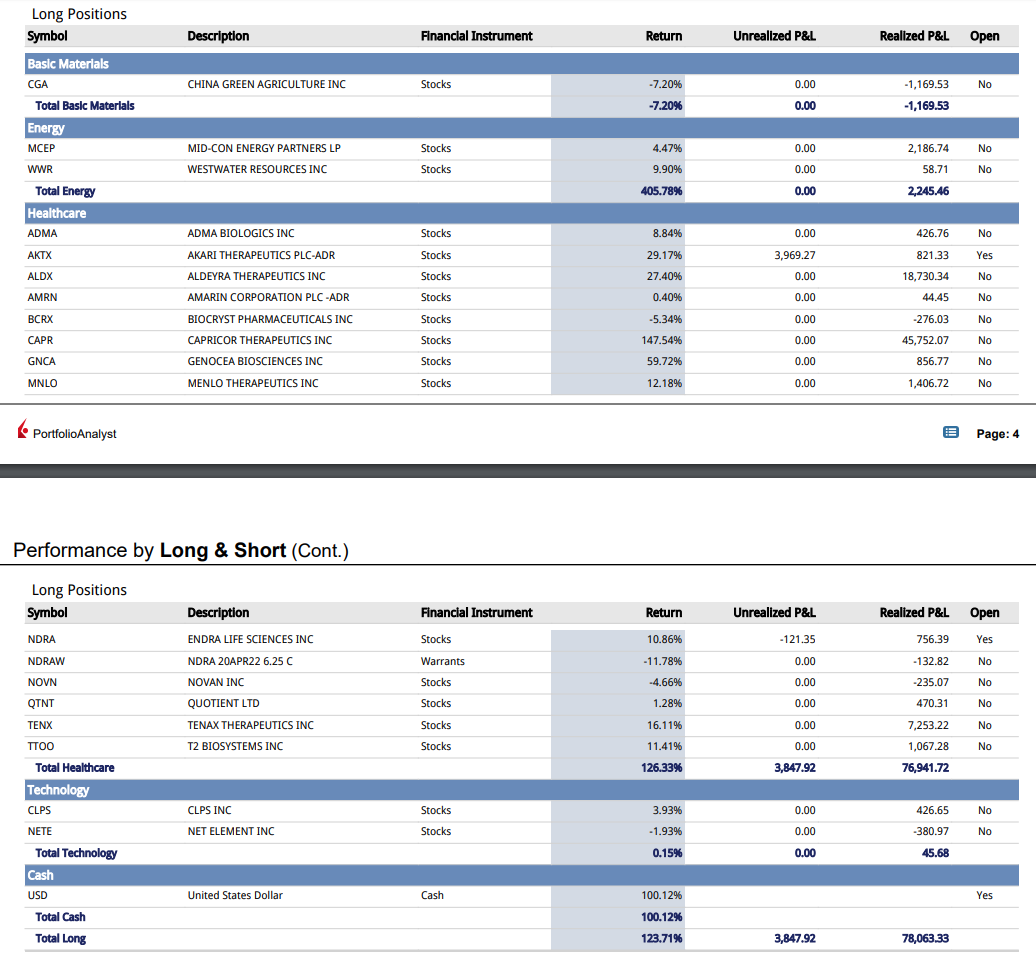

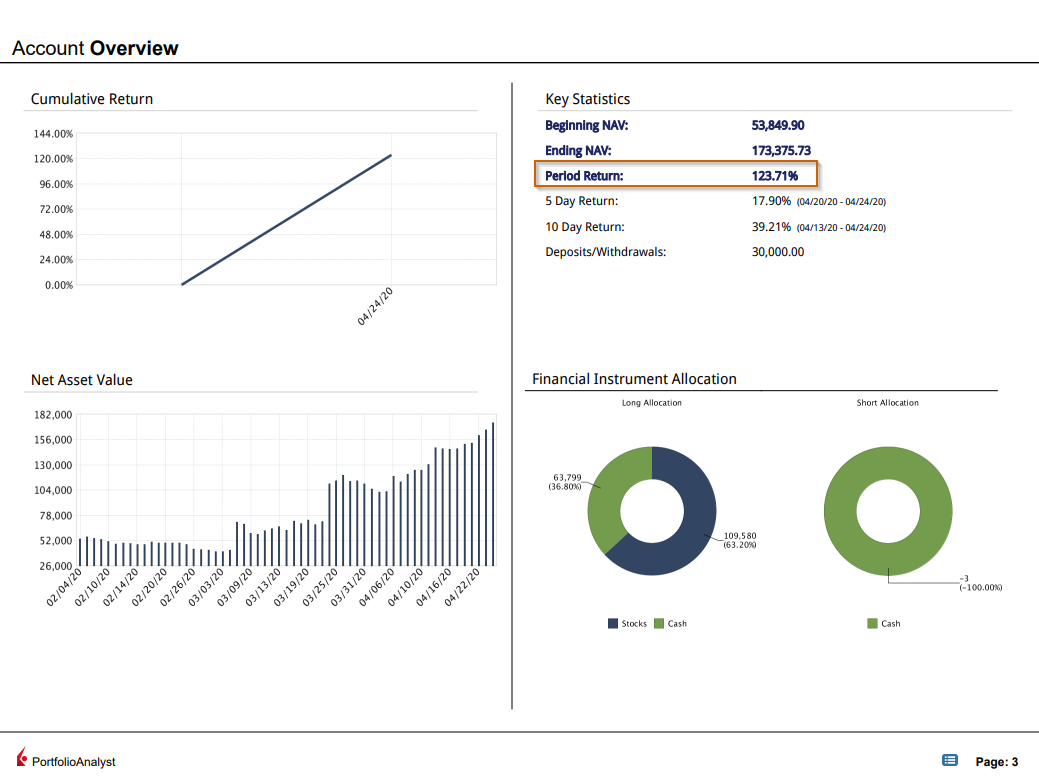

So here’s what happened in the second half of May. Made a few thousand dollars on my $AKTX swing. $NDRA swing was also successful with about $16K in gains. This is one ticker I’m still really torn on. Tremendous potential for the company but still unsure how quickly they can execute to their plan. Have got exposure to the ticker in another account so when the swing started working in this account, I decided to book gains and reduce risk.

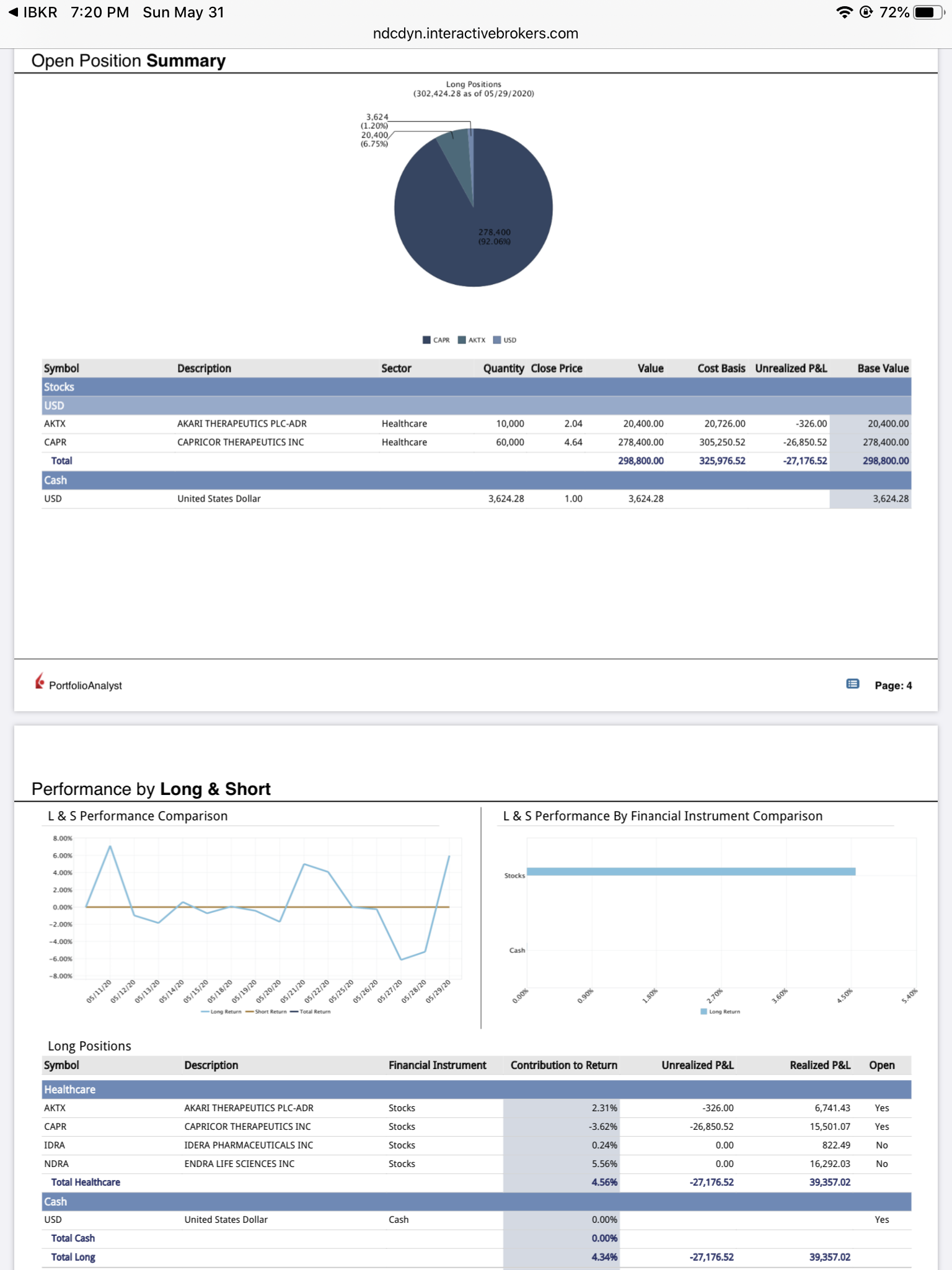

As we head into June, I’ve got two swings in the IB account: $CAPR and $AKTX. I’ve got a rather large position in $CAPR in this account because I really think the company is undervalued and remains at the cusp of an inflection point. Love their pipeline and willing to wait for the story to play out. $AKTX is another one I really like with catalysts in the coming weeks. I wish I could buy more $AKTX but the account is tapped out. Might move some money around from $CAPR to $AKTX but do think that $CAPR has potential to make a bigger move than $AKTX in the short term.