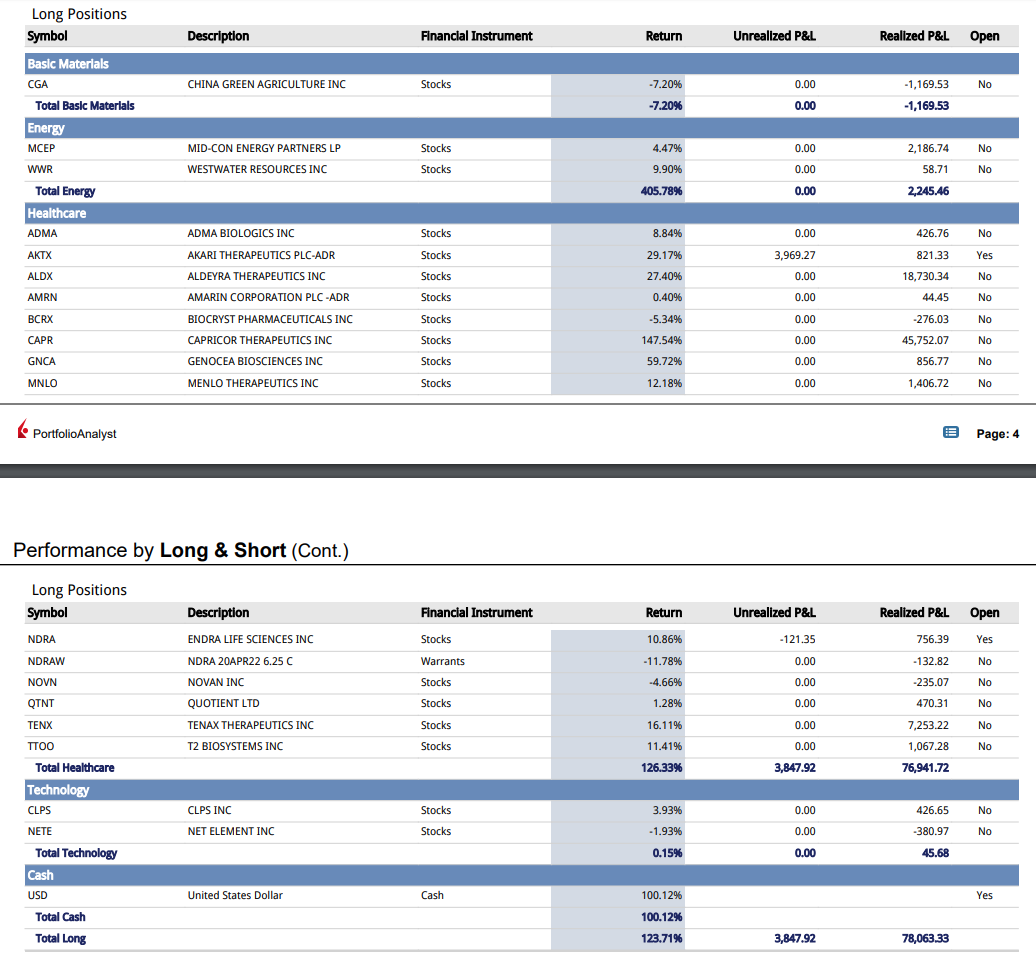

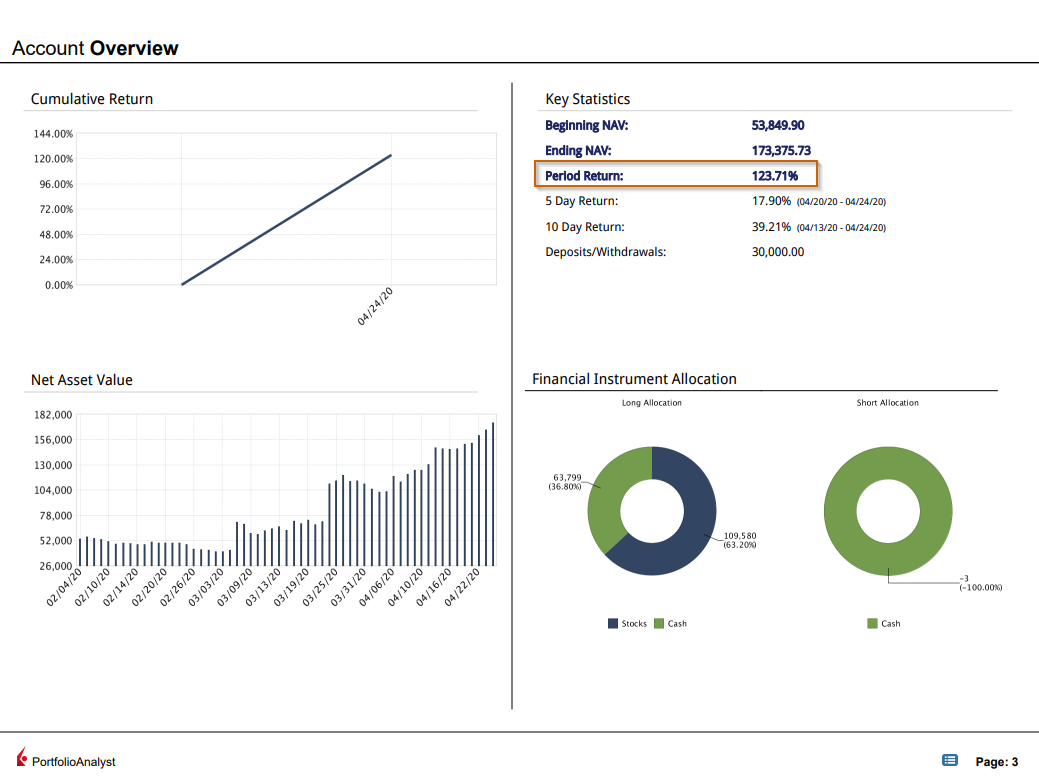

Got a bit tardy (again) keeping up with posting trade log here. Since last post, I sold $GRTS for a small gain, decided that I didn’t have much conviction in holding $CLBS so sold that for a 40¢ loss. In hindsight, entries for both $GRTS and $CLBS were mistimed a bit. Still interested in $GRTS so got that one on watch.

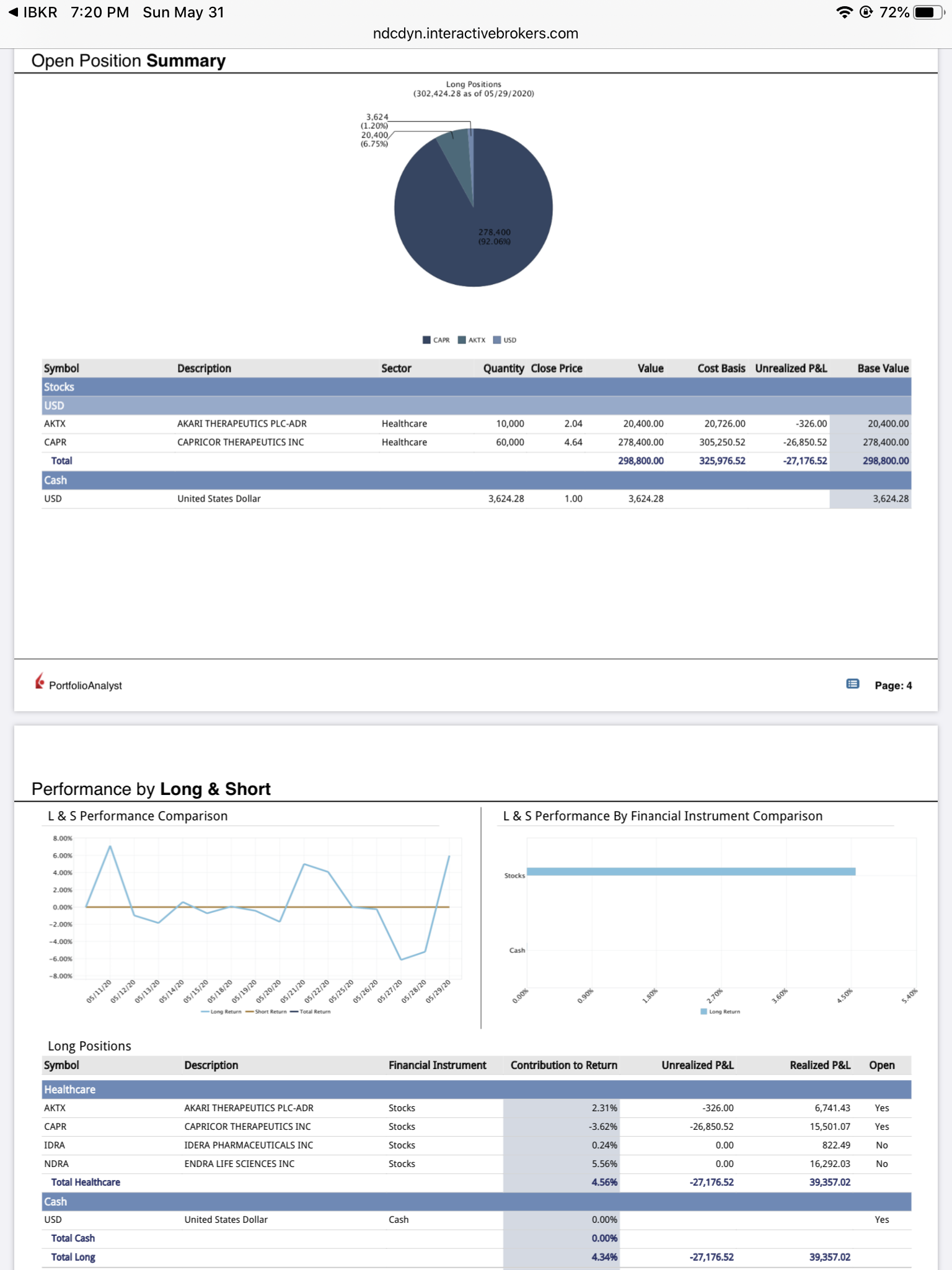

Used funds to buy more $AKTX as well start accumulating old friend $NDRA.

$AKTX is a waiting game for some bullish news. Stock has been in long consolidation, co has filed for a $30M new atm and they have catalysts lined up. All signs point to a big pump day not to mention stock is undervalued for the current pipeline.

$NDRA thesis is stock will get hot going into Fall with looming FDA update around Nov. Plus, based on most recent ER, co ramping up commercialization efforts in EU and may surprise the market by announcing some initial sales in EU. Cash runway is decent and co seems to have a plan going forward. May need patience on this one to fully realize the swing potential.